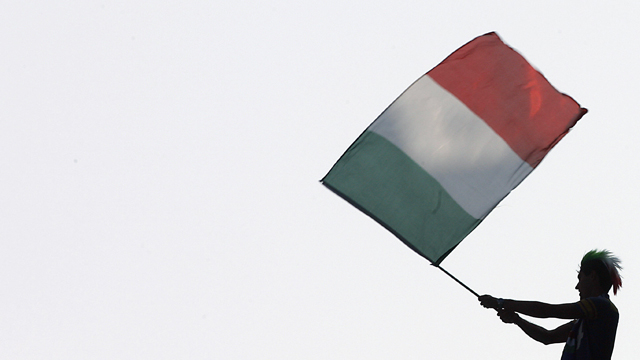

Can Italy be saved? If not, what happens next?

As the economist Mario Monti’s new government takes office in Italy, much is at stake – for the country, for Europe and for the global economy. If reforms falter, public finances collapse and anemic growth persists, Italy’s commitment to the euro will diminish as the perceived costs of membership come to outweigh the benefits. And Italy’s defection from the common currency – unlike that of smaller countries, like Greece – would threaten the eurozone to the core.

As the economist Mario Monti’s new government takes office in Italy, much is at stake – for the country, for Europe and for the global economy. If reforms falter, public finances collapse and anemic growth persists, Italy’s commitment to the euro will diminish as the perceived costs of membership come to outweigh the benefits. And Italy’s defection from the common currency – unlike that of smaller countries, like Greece – would threaten the eurozone to the core.Italy is a large economy, with annual GDP of more than $2 trillion. Its public debt is 120% of GDP, or roughly $2.4 trillion, which does not include the liabilities of a pension system in need of significant adjustments to reflect an aging population and increased longevity. As a result, Italy has become the world’s third-largest sovereign-debt market.

But rising interest rates are causing the debt-service burden to become onerous and politically unsustainable. Furthermore, Italy must refinance €275 billion ($372 billion) of its debt in the next six months, while investors, seeking to reduce their financial exposure to the country, are driving the yield on Italian ten-year bonds to prohibitively high levels – currently above 7%.

The need to refinance outstanding debt is not the only challenge. Domestic and foreign bondholders, especially banks, have experienced capital losses, which have damaged balance sheets, capital adequacy, and confidence. The trade and current-account deficits are large and rising, probably reflecting a loss of competitiveness and productivity relative to Germany and France, two of Italy’s largest trading partners. Moreover, economic growth has been slow for the past decade, and is not accelerating, which will make it difficult to lower the public-debt burden even with fiscal consolidation. more

No comments